who pays sales tax when selling a car privately in michigan

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Per the Daily Herald if you live inside the city of Chicago you will be charged an additional city sales tax of 125.

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

The buyer pays the sales tax when you register as the new legal owner of the vehicle.

. In most cases buyers. The seller paid sales tax when they bought the car so they only pay income tax on. A recent study by the Tax Policy Institute found that the average citizen who pays a 50 sales tax is about 770 per household.

To calculate how much sales tax youll owe simply. The minimum is 725. Buyer The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

The buyer pays sales tax on the purchase price of the car. Who pays sales tax when selling a car privately Uncategorized February 7 2021 Uncategorized February 7 2021. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Multiply the vehicle price after trade-in andor incentives by the.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to. Start and Finish in Minutes. When you sell your car you must declare the actual.

In Washington the average citizen is paying about. Private party sales within most states are not exempt from car. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

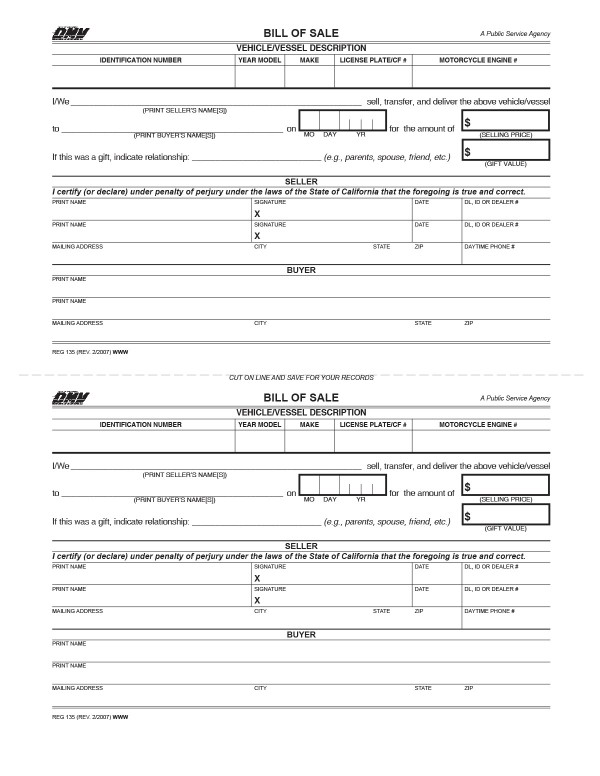

When you sell a car who pays taxes. But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car. If you dont obtain a DTF-802 completed by the seller DMV will use the fair.

Tax on used vehicles. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Its added to the initial cost of registration.

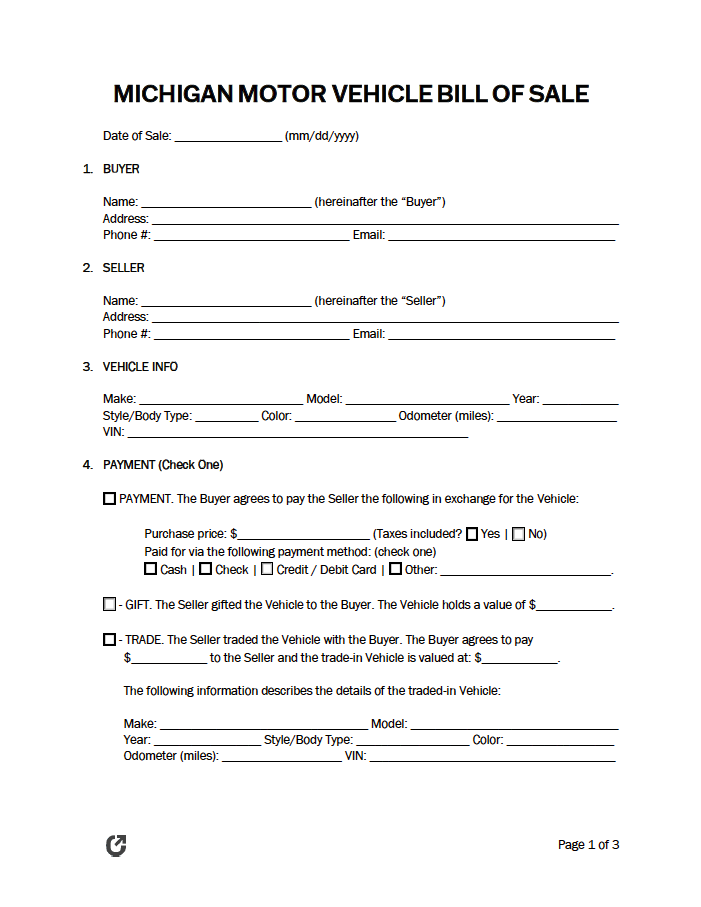

If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. The Michigan Department of Treasury. You do not pay sales tax to the seller.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Who pays sales tax when selling a car privately. For example if you decide to sell privately.

However if you bought it for. If I sell my car do I pay taxes. Also if the dealership handles your vehicles documentation.

Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. The buyer will pay sales tax on the purchase price of the. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged.

Multiply the vehicle price before trade-in or incentives by the sales tax.

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

If I Buy A Car In Another State Where Do I Pay Sales Tax

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

How To Close A Private Car Sale Edmunds

Finding The Out The Door Price When Buying A Car Cargurus

Strange Michigan Law No Car Sales On Sunday

Free Michigan Motor Vehicle Bill Of Sale Form Pdf Word Rtf

7 Steps How To Get A Michigan Car Dealer License Surety Solutions A Gallagher Company

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

All About Bills Of Sale In California The Facts And Forms You Need

Used Cars In Michigan For Sale Enterprise Car Sales

New And Used Car Sales Tax Costs Examined Carsdirect

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Dealer Manual State Of Michigan

Michigan Laws About Private Used Car Sales

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto